Senior Tax Accountant

BMG Outsourcing Inc.

Descripción del trabajo

Beneficios

Permisos

Permiso de Telecommunication, Permiso de transporte

Reconocimiento y Recompensas de Empleados

Programa de Reconocimiento de Empleados, Regalos de Navidad

Beneficios Mandados del Gobierno

Pago del mes 13, Fondo Pag-Ibig, Vacaciones pagadas, Salud, SSS/GSIS

Seguro de salud y bienestar

Seguro dental, HMO

Beneficios Beneficios

Equipo de la empresa, Comidas gratis

Tiempo de apagado y abandono

Salida de Bereavement, Abandonar maternidad y paternidad, Permiso parental, Salir por enfermedad, Abandonar Padre Solitario, Permiso especial para las mujeres, Salida por vacío

Grow your career with BMG Outsourcing – a leading, well-respected Australian-owned outsourcing company with offices in Clark and Sydney, offering long-term rewarding careers with our clients.

We are seeking a highly capable and detail-oriented Senior Tax Accountant to manage complex tax compliance and advisory work for Australian clients. The successful candidate will have strong technical knowledge of Australian taxation law, including Division 7A, Capital Gains Tax (CGT), and Fringe Benefits Tax (FBT), and will be responsible for preparing financial statements, tax returns, and workpapers from start to finish. You will work closely with clients and internal teams to ensure compliance, accuracy, and value-added service.

Job Responsibilities

Tax Compliance and Financial Reporting

- Manage end-to-end tax and compliance work for Australian entities including individuals, partnerships, companies, and trusts

- Prepare and review financial statements in accordance with Australian Accounting Standards

- Draft and lodge income tax returns ensuring compliance with current ATO requirements

Data Analysis and Software Integration

- Analyse and interpret financial information received from clients in a wide range of formats

- Enter and map data accurately into the client’s preferred accounting or tax software (e.g., Xero, MYOB, QuickBooks, HandiTax, APS)

ATO Portal Usage

- Access and retrieve client information from the ATO Portal including lodgement records, income tax accounts, integrated client accounts, PAYG instalments, and notices of assessment

- Use ATO data for reconciliation, lodgement tracking, and review of client obligations

Workpaper Preparation and Documentation

- Prepare comprehensive workpapers and supporting schedules based on client source data and software exports

- Ensure all workpapers meet internal documentation and audit standards

Accounting Adjustments and Reconciliations

- Process year-end adjusting journal entries

- Reconcile client records and update their accounting system to reflect finalized year-end balances and tax positions

Requirements

- 5+ years of experience in Australian taxation and compliance

- 5+ years of experience in Australian accounting

- Certified Public Accountant

- Experience in working with Australian SMEs

- Experience in the preparation and review of financial statements and income tax returns for individuals, sole traders, companies, and trusts

- Competent with computer operations as well as specific applications such as Xero, MYOB, QBO

- Excellent oral and written English communication skills

- Keen to learn and develop computer competencies

- Able to work independently through tasks until completion

- Excellent personal time and task management skills

- Ability to multi-task and meet deadlines

- Strong communication skills, excellent work ethic, and ability to work as part of a team

- Friendly, committed, and flexible attitude

- Positive mindset and strong willingness to learn

Diana Rose Dela Cruz

People and Culture AdminBMG Outsourcing Inc.

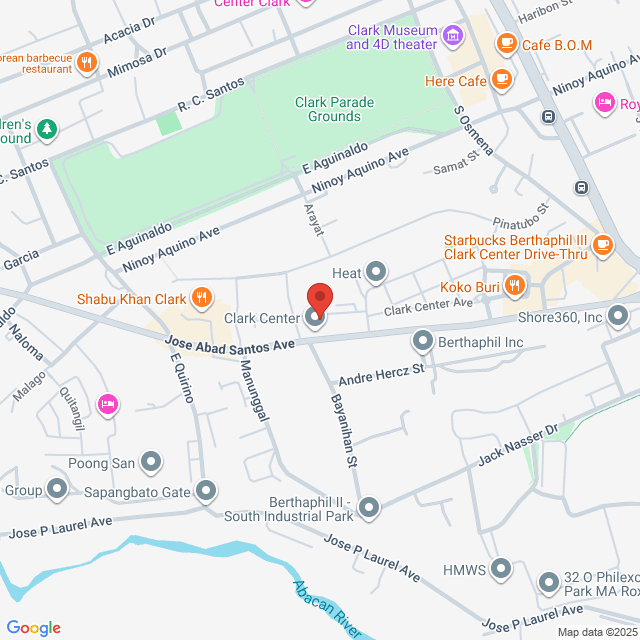

Ubicación laboral

Unit B 2nd Floor, 2/F Clark Center 9, Berthaphil, Pinatubo Ext. Jose Abad Santos Ave Zone, Clark Freeport, Angeles, 2023 Pampanga, Philippines

Publicado el 01 October 2025

Jobs similares

Ver másSenior Tax & Business Services Accountant

Cloudstaff

Cloudstaff€1.5-1.9K[Mensual]

En el sitio - ÁngelesExp de Yrs 5-10BaceleroTiempo completo

Jorge MaximoHR Officer

Tax Accountant

Digital Planners Corporation

Digital Planners Corporation€582-1K[Mensual]

En el sitio - ÁngelesExp de 3-5 YrsBaceleroTiempo completo

Digital Planners CorporationHR Officer

Tax Analyst

Amertron Incorporated

Amertron Incorporated€218-291[Mensual]

En el sitio - PampangaGraduado/Estudiante frescoBaceleroTiempo completo

Carla CuevasRecruitment Specialist

Accounting Assistant

FAST Laboratories

FAST Laboratories€262-291[Mensual]

En el sitio - ÁngelesNo se requiere ExpBaceleroTiempo completo

HR LouieHR Assistant

Senior Accountant

BMG Outsourcing Inc.

BMG Outsourcing Inc.€1.5-1.6K[Mensual]

En el sitio - ÁngelesExp de 3-5 YrsBaceleroTiempo completo

Diana Rose Dela CruzPeople and Culture Admin

Recordatorio de seguridad del jefe

Si la posición requiere que trabajes en el extranjero, por favor ten cuidado y ten cuidado con el fraude.

Si encuentras a un empleador que tiene las siguientes acciones durante tu búsqueda de empleo, por favor repórtalo inmediatamente

- retiene tu ID,

- requiere que usted proporcione una garantía o recoja la propiedad,

- le obliga a invertir o recaudar fondos.

- recauda beneficios ilícitos,

- u otras situaciones ilegales.